The Bull Case for Helium in 2024 📈

We know it’s been a while since many of you have thought about Helium so we wanted to give you a quick update on what’s

In this article, we will be going over the quickest and easiest way to report your Helium earnings on your taxes. All it takes is two very powerful yet simple websites and this short guide. Now before we begin it should be noted that we are not tax professionals and are not qualified to give any kind of tax or financial advice. What you will find in this guide is our current understanding of the process to file your Helium Mining income in the United States. It should also be noted that every country/jurisdiction has different laws and ways of treating mined cryptocurrency. This post is for informational purposes only, please consult with a qualified tax professional before filing your Helium taxes.

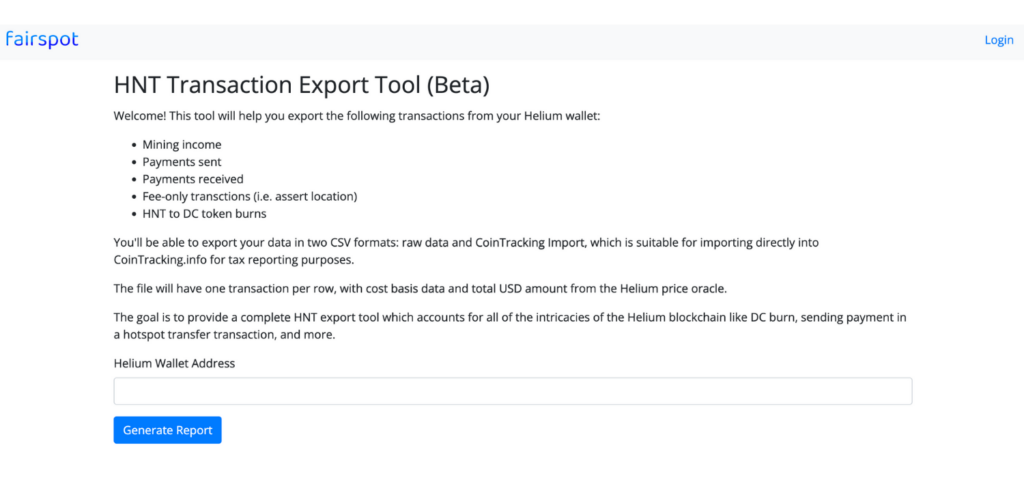

First, you’ll need to open Fairspot’s Helium Mining Transaction Export Tool and enter your HNT wallet address.

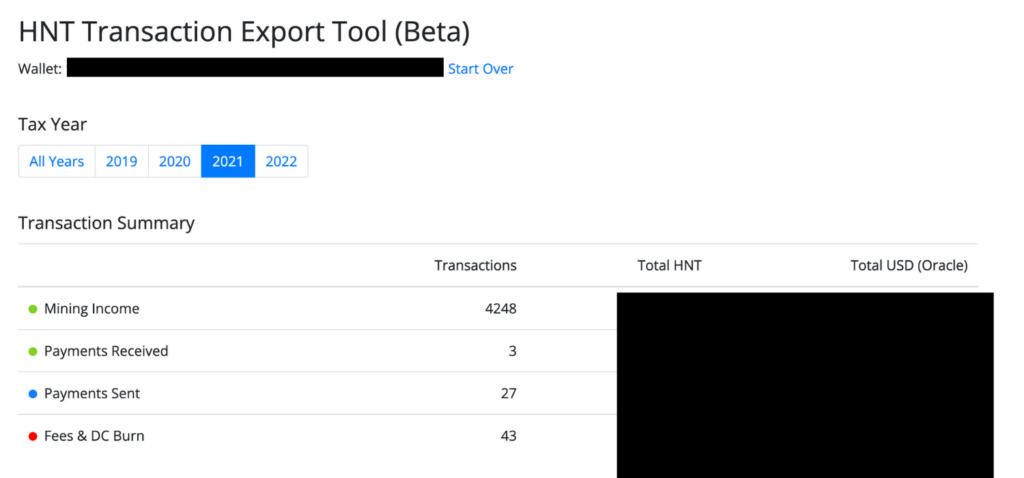

Then, you will be taken to a page like this, it will show you metrics such as mining income, payments, and fees. You will be displayed results in HNT and USD.

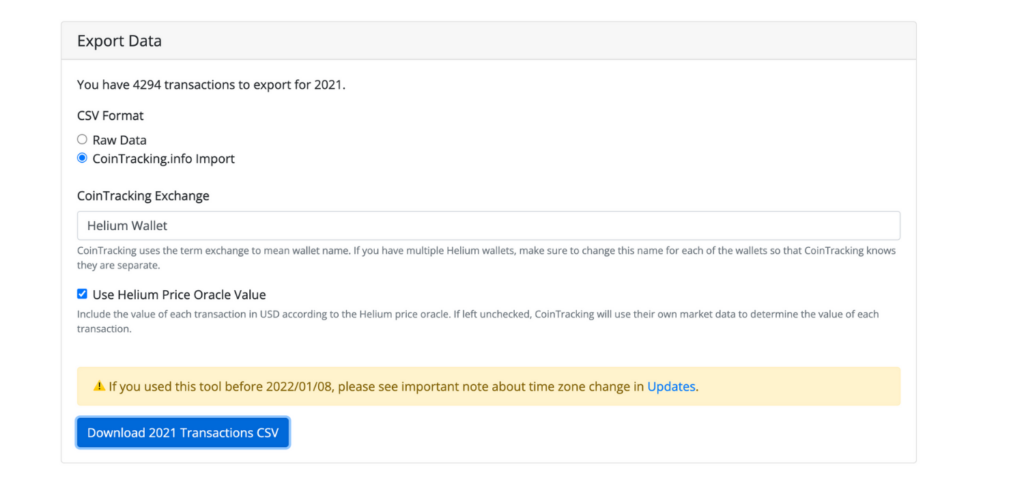

When you scroll down, you will see the Export Data portion of the screen, from here, you can prepare your data for the next step. We recommend using CoinTracker for this step because these websites integrate so well.

Select CoinTracker.info import then download the CSV file.

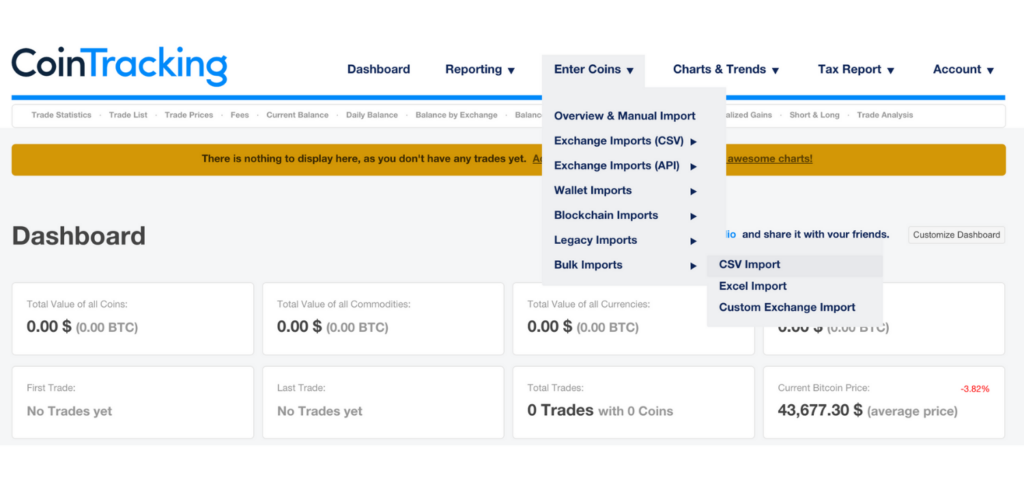

Once you have downloaded the file, head over to CoinTracking.info and make a free account. CoinTracking.info allows you to calculate taxes on up to 200 transactions for free. For more than 200 transactions, use our affiliate link to save 10%.

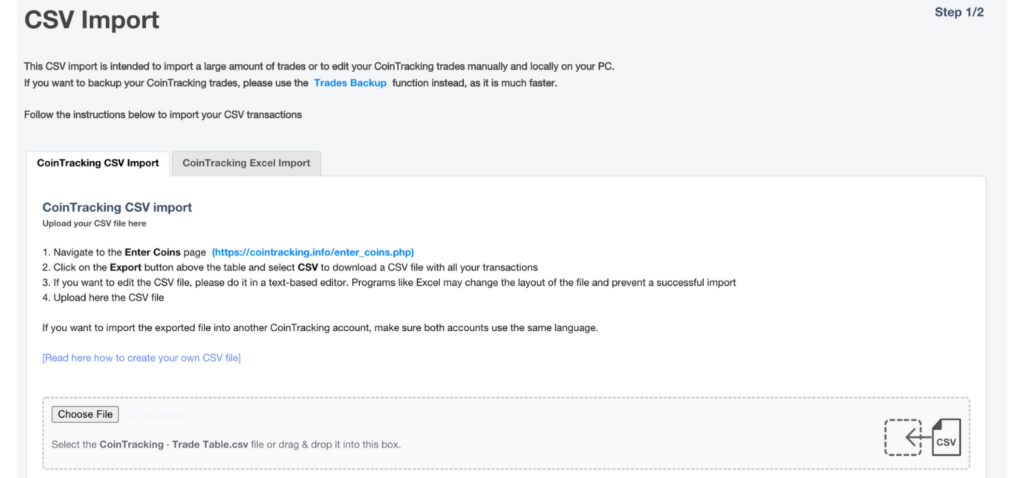

Next, you’ll want to navigate to the “Enter Coins” tab and select “CSV Import” under “Bulk Imports”.

Then you’ll need to import the file you just downloaded from Fairspot via the “Choose File” button.

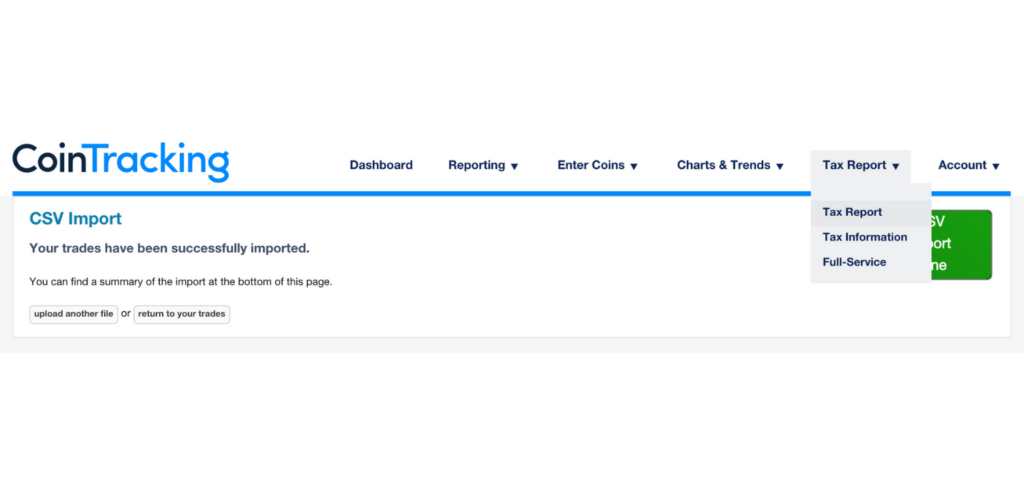

After you’ve followed the prompts and completely uploaded your CSV file, you’ll want to navigate to the “Tax Report” tab.

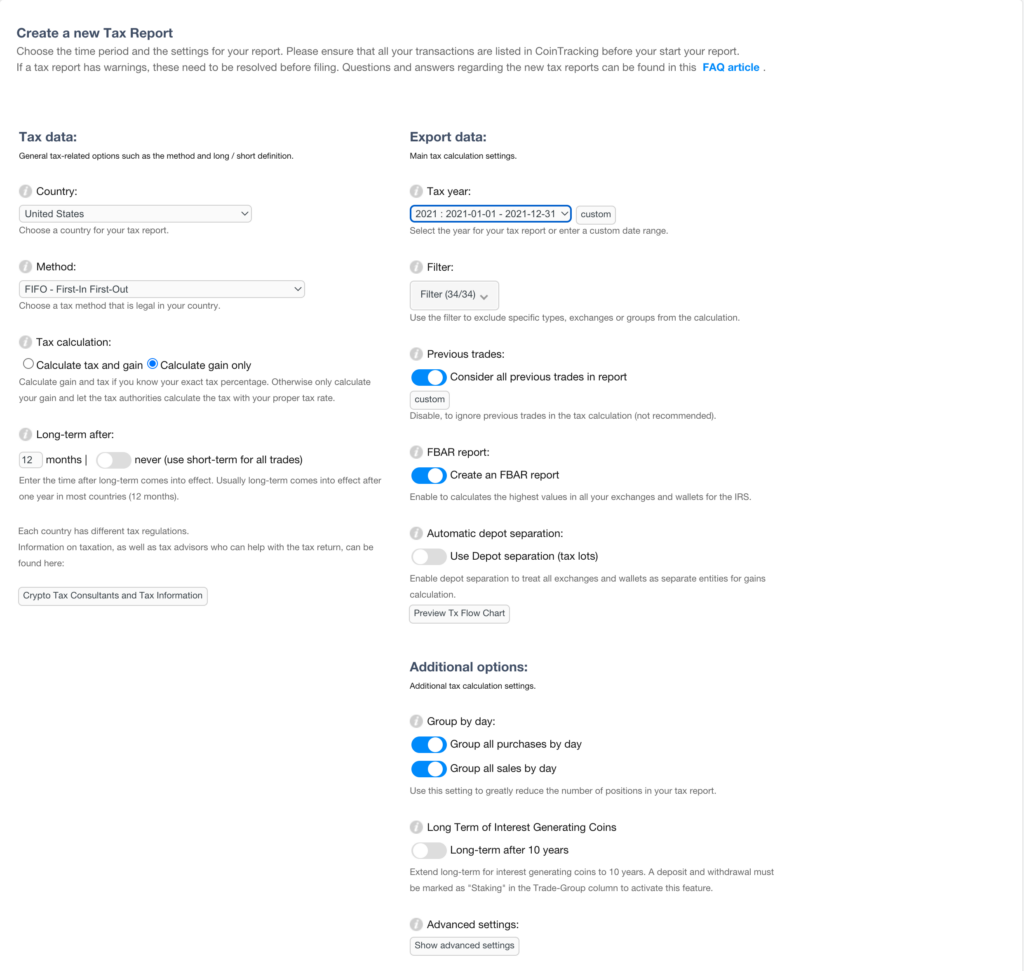

Once there, you can begin to fill out the rest of your tax preferences. We recommend consulting a licensed tax professional when filling out these settings. For “Method” most companies/individuals in the US must use FIFO.

After you’ve generated the report, you can scroll down and see the report for yourself. If you bought or sold any of the mined HNT during the Tax year you will then need to import these trades into CoinTracking.info so CoinTracking.info can calculate any Capital Gains/Losses incurred during the tax year.

The report will have Capital Gains, Income, Fees, and Unrealized Gains. All of the metrics you need to use when filing your Helium taxes. As always please consult with a qualified tax professional before filing your taxes.

For more information on how to maximize your HNT earings, check out this blog post.

We know it’s been a while since many of you have thought about Helium so we wanted to give you a quick update on what’s

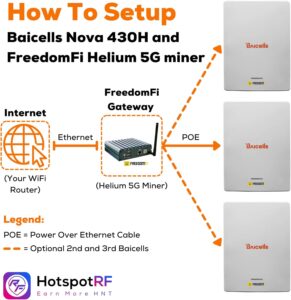

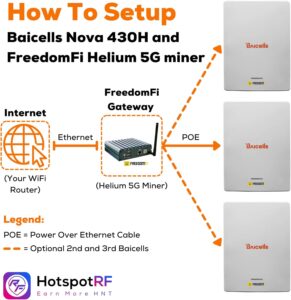

You used the Helium Coverage Planner to find the best location, azimuth, height, and elevation to maximize your 5G coverage and rewards. You ordered your

Helium and T-Mobile have just announced that they have entered a five-year deal in which the companies will work together to provide people with a

HIP 70 is the latest update to the Helium network that gives more rewards and features to individual Hotspot owners. In this article, we will

What is a DAO? DAO stands for decentralized autonomous organization, which means that ownership and decision-making are spread between each individual shareholder. Traditionally, the rules

It has been an exciting time at HotspotRF. We just got our very own bare metal server, codename Reaper, that holds our ETL! You can

We know it’s been a while since many of you have thought about Helium so we wanted to give you a quick update on what’s

You used the Helium Coverage Planner to find the best location, azimuth, height, and elevation to maximize your 5G coverage and rewards. You ordered your

Helium and T-Mobile have just announced that they have entered a five-year deal in which the companies will work together to provide people with a

HotspotRF: A staple in the Helium Community since 2021. Discover a full suite of Helium solutions, from 5G mining hardware to advanced IoT simulations and host matching services. Streamline your operations and increase your earnings with our expertly designed solutions.